Insights

West Virginia Tax Rate Reduction

By: Miri Hunter, CPA, CVA, CGMA The West Virginia State Tax Department has announced that effective January 1, 2025, the personal income tax rates will be reduced by 4%, which will bring the top rate down from 5.12% to 4.92%. The tax rate is a graduated tax rate which based…

Read More2024 Year-End Tax Planning Guide

At Suttle & Stalnaker, PLLC we are dedicated to helping you maximize your income through various tax-saving strategies. We are excited to share our 2024 Year-End Year-Round Tax Planning Guide. There are numerous tax developments to consider for the current tax year. However, keep in mind that this resource is intended to provide general suggestions…

Read MoreMake year-end tax planning moves before it’s too late!

With the arrival of fall, it’s an ideal time to begin implementing strategies that could reduce your tax burden for both this year and next. One of the first planning steps is to ascertain whether you’ll take the standard deduction or itemize deductions for 2024. You may not itemize because of the high 2024 standard…

Read MoreIRS Update – Hurricane Helene Victims

By: Tricia Clark, CPA The IRS has provided filing relief to those affected by Hurricane Helene. Individuals and businesses in the entire states of Alabama, Georgia, North Carolina and South Carolina, and parts of Florida, Tennessee and Virginia will qualify. The relief is in the form of an extension of time to file and/or pay until…

Read MoreHelp ensure your partnership or LLC complies with tax law

When drafting partnership and LLC operating agreements, various tax issues must be addressed. This is also true of multi-member LLCs that are treated as partnerships for tax purposes. Here are some critical issues to include in your agreement so your business remains in compliance with federal tax law. Identify and describe guaranteed payments to partners…

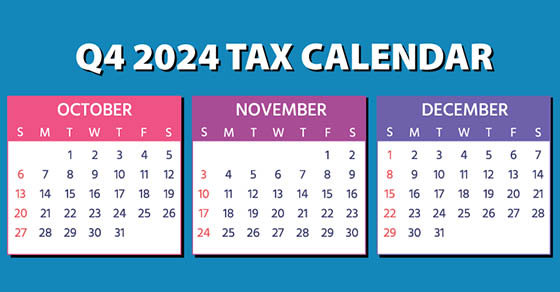

Read More2024 Q4 tax calendar: Key deadlines for businesses and other employers

Here are some of the key tax-related deadlines affecting businesses and other employers during the fourth quarter of 2024. Keep in mind that this list isn’t all-inclusive, so there may be additional deadlines that apply to you. Contact us to ensure you’re meeting all applicable deadlines and to learn more about the filing requirements. Note:…

Read MoreWorking remotely is convenient, but it may have tax consequences

Many employees began working remotely during the pandemic and continue doing so today. Remote work has many advantages for employers and employees, and as a result, it’s here to stay in many industries. But it may also lead to some tax surprises, especially if workers cross state lines. Double taxation may occur It’s not unusual…

Read MoreUnderstanding the $7,500 federal tax credit for buying an electric vehicle

Electric vehicles (EVs) have become increasingly popular. According to Kelley Blue Book estimates, the EV share of the vehicle market in the U.S. was 7.6% in 2023, up from 5.9% in 2022. To incentivize the purchase of EVs, there’s a federal tax credit of up to $7,500 for eligible vehicles. The tax break for EVs…

Read MoreIt’s time for your small business to think about year-end tax planning

With Labor Day in the rearview mirror, it’s time to take proactive steps that may help lower your small business’s taxes for this year and next. The strategy of deferring income and accelerating deductions to minimize taxes can be effective for most businesses, as is the approach of bunching deductible expenses into this year or…

Read More6 tax-free income opportunities

Believe it or not, there are ways to collect tax-free income and gains. Here are some of the best opportunities to put money in your pocket without current federal income tax implications: Roth IRAs offer tax-free income accumulation and withdrawals. Unlike withdrawals from traditional IRAs, qualified Roth IRA withdrawals are free from federal income tax. A…

Read MoreSUBSCRIBE TO OUR NEWSLETTER

Receive timely news and updates from our newsletter.