Insights

The Nanny-Tax: Here’s How It Might Impact You

You may have heard of the “nanny tax.” But if you don’t employ a nanny, you may think it doesn’t apply to you. Check again. Hiring a housekeeper, gardener or other household employee (who isn’t an independent contractor) may make you liable for federal income and other taxes. You may also have state tax obligations.…

Read MoreGuide to Job Costing for Construction Contractors

By: Sarah Murphy As a construction contractor, mastering the art of job costing is essential for the success and profitability of your projects. Accurate job costing allows you to understand the proper expenses associated with each project, make informed decisions, and optimize resource allocation. Below are three crucial aspects of job costing: committed costs, work-in-progress…

Read More2023 Affordable Care Act (ACA) Reporting Deadlines and Potential Penalties

By: Drema Foster, PAFM As we’re closing in on 2024, employers must be aware of the most recent changes to Affordable Care Act (ACA) reporting. Since 2015, employers have been able to file their Forms 1094-C and 1095-C by paper rather than electronically if they were filing less than 250 returns. However, beginning in 2024,…

Read MoreEscheatment 2023: What You Need to Know

By: Randy Cole With recent changes to unclaimed property laws in West Virginia, now is a good time for a refresher on the escheatment laws currently in place to ensure your bank is in compliance. Notable changes to laws over the last few years include reduced dormancy periods for certain property types and guidelines on…

Read More2023 Year-End Tax Planning Guide

At Suttle & Stalnaker, PLLC we are dedicated to helping you maximize your income through various tax-saving strategies. We are excited to share our 2023 Year-End Year-Round Tax Planning Guide. There are numerous tax developments to consider for the current tax year. However, keep in mind that this resource is intended to provide general suggestions…

Read MoreThe tax implications of renting out a vacation home

Many Americans own a vacation home or aspire to purchase one. If you own a second home in a waterfront community, in the mountains or in a resort area, you may want to rent it out for part of the year. The tax implications of these transactions can be complicated. It depends on how many…

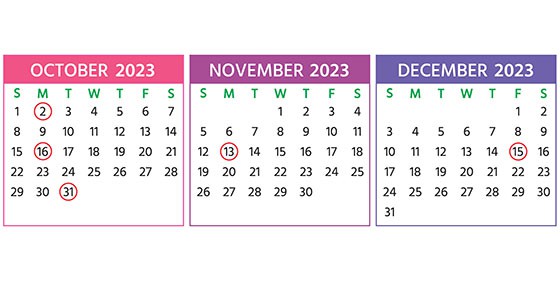

Read More2023 Q4 tax calendar: Key deadlines for businesses and other employers

Here are some of the key tax-related deadlines affecting businesses and other employers during the fourth quarter of 2023. Keep in mind that this list isn’t all-inclusive, so there may be additional deadlines that apply to you. Contact us to ensure you’re meeting all applicable deadlines and to learn more about the filing requirements. Note:…

Read MoreAre scholarships tax-free or taxable?

With the rising cost of college, many families are in search of scholarships to help pay the bills. If your child is awarded a scholarship, you may wonder about how it could affect your family’s taxes. Good news: Scholarships (and fellowships) are generally tax-free for students at elementary, middle and high schools, as well as…

Read MoreBusiness automobiles: How the tax depreciation rules work

Do you use an automobile in your trade or business? If so, you may question how depreciation tax deductions are determined. The rules are complicated, and special limitations that apply to vehicles classified as passenger autos (which include many pickups and SUVs) can result in it taking longer than expected to fully depreciate a vehicle.…

Read MoreWhat types of expenses can’t be written off by your business?

If you read the Internal Revenue Code (and you probably don’t want to!), you may be surprised to find that most business deductions aren’t specifically listed. For example, the tax law doesn’t explicitly state that you can deduct office supplies and certain other expenses. Some expenses are detailed in the tax code, but the general…

Read MoreSUBSCRIBE TO OUR NEWSLETTER

Receive timely news and updates from our newsletter.