Insights: Tax Services

Pass-Through Entity Tax-What Does It Mean For Me?

By: Trey Suttle, CPA The Tax Cuts and Jobs Act of 2017 (“TCJA”) made a major change to the amount of state and local taxes paid that could be deducted on an individual’s income tax return. Prior to the legislation, there was no cap on the amount of state and local taxes paid that could…

Read MoreThe Nanny-Tax: Here’s How It Might Impact You

You may have heard of the “nanny tax.” But if you don’t employ a nanny, you may think it doesn’t apply to you. Check again. Hiring a housekeeper, gardener or other household employee (who isn’t an independent contractor) may make you liable for federal income and other taxes. You may also have state tax obligations.…

Read More2023 Year-End Tax Planning Guide

At Suttle & Stalnaker, PLLC we are dedicated to helping you maximize your income through various tax-saving strategies. We are excited to share our 2023 Year-End Year-Round Tax Planning Guide. There are numerous tax developments to consider for the current tax year. However, keep in mind that this resource is intended to provide general suggestions…

Read MoreThe tax implications of renting out a vacation home

Many Americans own a vacation home or aspire to purchase one. If you own a second home in a waterfront community, in the mountains or in a resort area, you may want to rent it out for part of the year. The tax implications of these transactions can be complicated. It depends on how many…

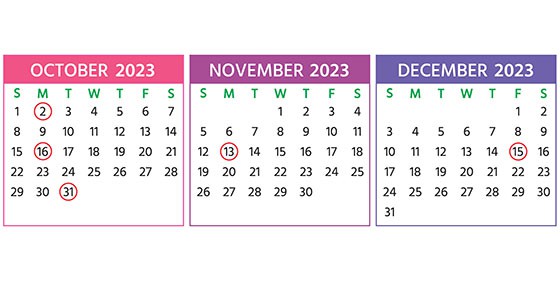

Read More2023 Q4 tax calendar: Key deadlines for businesses and other employers

Here are some of the key tax-related deadlines affecting businesses and other employers during the fourth quarter of 2023. Keep in mind that this list isn’t all-inclusive, so there may be additional deadlines that apply to you. Contact us to ensure you’re meeting all applicable deadlines and to learn more about the filing requirements. Note:…

Read MoreAre scholarships tax-free or taxable?

With the rising cost of college, many families are in search of scholarships to help pay the bills. If your child is awarded a scholarship, you may wonder about how it could affect your family’s taxes. Good news: Scholarships (and fellowships) are generally tax-free for students at elementary, middle and high schools, as well as…

Read MoreBusiness automobiles: How the tax depreciation rules work

Do you use an automobile in your trade or business? If so, you may question how depreciation tax deductions are determined. The rules are complicated, and special limitations that apply to vehicles classified as passenger autos (which include many pickups and SUVs) can result in it taking longer than expected to fully depreciate a vehicle.…

Read MoreWhat types of expenses can’t be written off by your business?

If you read the Internal Revenue Code (and you probably don’t want to!), you may be surprised to find that most business deductions aren’t specifically listed. For example, the tax law doesn’t explicitly state that you can deduct office supplies and certain other expenses. Some expenses are detailed in the tax code, but the general…

Read MoreDivorcing business owners should pay attention to the tax consequences

If you’re getting a divorce, you know the process is generally filled with stress. But if you’re a business owner, tax issues can complicate matters even more. Your business ownership interest is one of your biggest personal assets and in many cases, your marital property will include all or part of it. Transferring property tax-free…

Read MorePurchasing Construction Equipment with Cash or Financing: What is the Impact on Your Financial Statements and Tax Returns?

By: Danny Shobe, CPA, CCIFP Having the right equipment to do a job can be highly critical to the success of a construction company. Deciding whether to purchase or rent the necessary equipment is a significant decision all construction company management teams and owners face each year. Once one chooses to purchase equipment, the next…

Read MoreSUBSCRIBE TO OUR NEWSLETTER

Receive timely news and updates from our newsletter.