Insights: Client Accounting Services

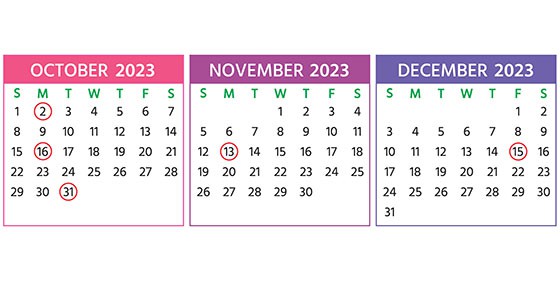

2023 Q4 tax calendar: Key deadlines for businesses and other employers

Here are some of the key tax-related deadlines affecting businesses and other employers during the fourth quarter of 2023. Keep in mind that this list isn’t all-inclusive, so there may be additional deadlines that apply to you. Contact us to ensure you’re meeting all applicable deadlines and to learn more about the filing requirements. Note:…

Read MoreBusiness automobiles: How the tax depreciation rules work

Do you use an automobile in your trade or business? If so, you may question how depreciation tax deductions are determined. The rules are complicated, and special limitations that apply to vehicles classified as passenger autos (which include many pickups and SUVs) can result in it taking longer than expected to fully depreciate a vehicle.…

Read MoreWhat types of expenses can’t be written off by your business?

If you read the Internal Revenue Code (and you probably don’t want to!), you may be surprised to find that most business deductions aren’t specifically listed. For example, the tax law doesn’t explicitly state that you can deduct office supplies and certain other expenses. Some expenses are detailed in the tax code, but the general…

Read MoreManaging your Finances as a Small Business Owner

By: Steve Morgan, CPA, MBA Sometimes financial tasks can be daunting to a small business owner. However, managing the financial aspects of a small business is crucial for its success. Below is a financial checklist that can help small businesses stay organized and compliant: Register your business: Ensure you have correctly registered your business with…

Read MoreSolo business owner? There’s a 401(k) for that

If you own a successful small business with no employees, you might be ready to set up a retirement plan. Now a 401(k) might seem way out of your reach — only bigger companies can manage one of those, right? Not necessarily. Two ways to contribute With a solo 401(k), the self-employed can make large annual deductible contributions to…

Read MoreLeveraging Common AI Tools to Boost Small Business Success

By: Saundra Uy, CPA, CVA, CGMA In today’s rapidly evolving business landscape, small businesses face numerous challenges to stay competitive and thrive. However, technological advancements, specifically in artificial intelligence (AI), have opened new possibilities for small business owners. AI tools have become more accessible, affordable, and user-friendly, providing small businesses with powerful resources to streamline…

Read MoreStarting a business? How expenses will be treated on your tax return

Government officials saw a large increase in the number of new businesses launched during the COVID-19 pandemic. And the U.S. Census Bureau reports that business applications are still increasing slightly (up 0.4% from April 2023 to May 2023). The Bureau measures this by tracking the number of businesses applying for Employer Identification Numbers. If you’re…

Read MoreStrengthening Business Operations: The Importance of Internal Controls for Vendors, W-9 Tax Forms, and Issuing 1099s

Written By: Saudra Uy, CPA CVA CGMA Effective internal controls are the backbone of any well-managed business. They play a crucial role in safeguarding assets, ensuring accurate financial reporting, and mitigating the risk of fraud. When it comes to vendor management and tax compliance, implementing robust internal controls is vital. In this article, we will…

Read MoreHiring family members can offer tax advantages (but be careful)

Summertime can mean hiring time for many types of businesses. With legions of working-age kids and college students out of school, and some spouses of business owners looking for part-time or seasonal work, companies may have a much deeper hiring pool to dive into this time of year. If you’re considering hiring your children or spouse,…

Read MoreUse the tax code to make business losses less painful

Whether you’re operating a new company or an established business, losses can happen. The federal tax code may help soften the blow by allowing businesses to apply losses to offset taxable income in future years, subject to certain limitations. Qualifying for a deduction The net operating loss (NOL) deduction addresses the tax inequities that can…

Read MoreSUBSCRIBE TO OUR NEWSLETTER

Receive timely news and updates from our newsletter.