Insights

Filing jointly or separately as a married couple: What’s the difference?

When you file your tax return, a tax filing status must be chosen. This status is used to determine your standard deduction, tax rates, eligibility for certain tax breaks and your correct tax. The five filing statuses are: Single Married filing jointly, Married filing separately, Head of household, and Qualifying surviving spouse. If you’re married,…

Read MoreUpdate on IRS efforts to combat questionable Employee Retention Tax Credit claims

The Employee Retention Tax Credit (ERTC) was introduced back when COVID-19 temporarily closed many businesses. The credit provided cash that helped enable struggling businesses to retain employees. Even though the ERTC expired for most employers at the end of the third quarter of 2021, it could still be claimed on amended returns after that. According…

Read MoreIf you gave to charity in 2023, check to see that you have substantiation

Did you donate to charity last year? Acknowledgment letters from the charities you gave to may have already shown up in your mailbox. But if you don’t receive such a letter, can you still claim a deduction for the gift on your 2023 income tax return? It depends. What the law requires To prove a…

Read MoreIs your business subject to the new BOI reporting rules?

The Corporate Transparency Act (CTA) was signed into law to help the government prevent crimes commonly associated with illegal business activities such as terrorist financing and money laundering. If your business can be defined as a “reporting company” under the CTA, you may need to comply with new beneficial ownership information (BOI) reporting rules took…

Read MoreKey 2024 inflation-adjusted tax amounts for individuals

The IRS recently announced various 2024 inflation-adjusted federal tax amounts that affect individual taxpayers. Most of the federal income tax rate bracket thresholds are about 5.4% higher than for 2023. That means that you can generally have about 5.4% more income next year without owing more to the federal government. Standard deduction Here are the…

Read MoreDon’t overlook taxes when contemplating a move to another state

When you retire, you may think about moving to another state — perhaps because the weather is more temperate or because you want to be closer to family members. Don’t forget to factor state and local taxes into the equation. Establishing residency for state tax purposes may be more complex than you think. Pinpoint all…

Read MoreA company car is a valuable perk but don’t forget about taxes

One of the most appreciated fringe benefits for owners and employees of small businesses is the use of a company car. This perk results in tax deductions for the employer as well as tax breaks for the owners and employees driving the cars. (And of course, they enjoy the nontax benefit of using a company…

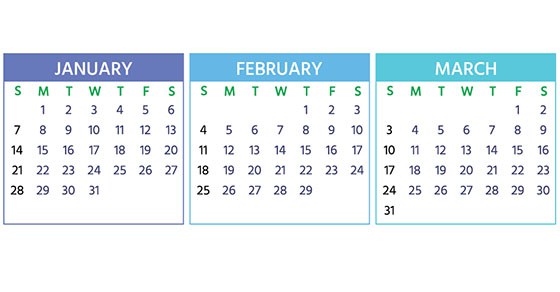

Read More2024 Q1 tax calendar: Key deadlines for businesses and other employers

Here are some of the key tax-related deadlines affecting businesses and other employers during the first quarter of 2024. Keep in mind that this list isn’t all-inclusive, so there may be additional deadlines that apply to you. If you have questions about filing requirements, contact us. We can ensure you’re meeting all applicable deadlines. January…

Read MoreThe standard business mileage rate will be going up slightly in 2024

The optional standard mileage rate used to calculate the deductible cost of operating an automobile for business will be going up by 1.5 cents per mile in 2024. The IRS recently announced that the cents-per-mile rate for the business use of a car, van, pickup or panel truck will be 67 cents (up from 65.5 cents for…

Read MoreNew per diem business travel rates kicked in on October 1

Are employees at your business traveling and frustrated about documenting expenses? Or perhaps you’re annoyed at the time and energy that goes into reviewing business travel expenses. There may be a way to simplify the reimbursement of these expenses. In Notice 2023-68, the IRS announced the fiscal 2024 special “per diem” rates that became effective…

Read MoreSUBSCRIBE TO OUR NEWSLETTER

Receive timely news and updates from our newsletter.